Employer of Record (EOR): A Strategic Perspective for Businesses

26/03/2025

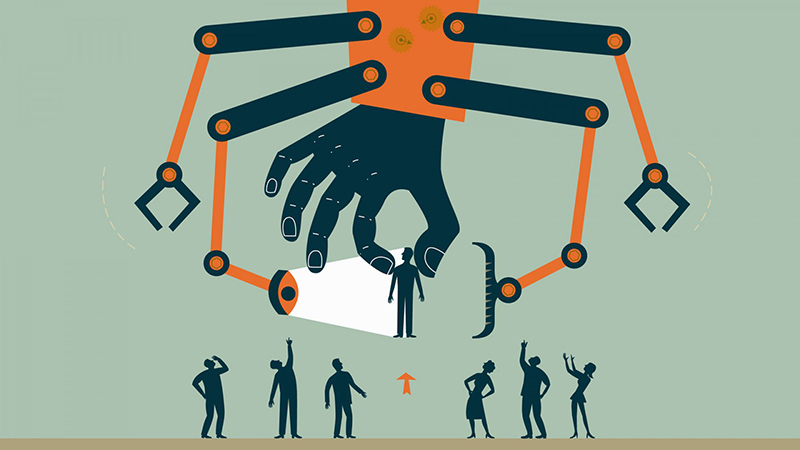

Legal Context and the Need for Employer of Record (EOR)

In an increasingly regulated business environment, Employer of Record (EOR) is not just an option but a necessity for companies seeking transparency and long-term sustainability. Labor contract regulations, social insurance policies, and personal income tax laws are being enforced more strictly, requiring businesses to adopt appropriate strategies to mitigate legal risks.

Challenges Businesses Face

- Stricter legal regulations: Authorities are intensifying inspections to ensure labor law compliance, prompting companies to reassess their workforce management models.

- Rising indirect labor costs: Companies may incur significant penalties if they fail to comply with labor regulations.

- Evolving work environment: The rise of the gig economy and remote work models presents new challenges in legally managing the workforce.

- Attracting and retaining talent: Skilled workers prefer businesses with clear and legal employment policies.

Analyzing the Benefits of Employer of Record (EOR)

1. Minimizing Legal Risks

Companies employing unregistered workers may face consequences such as:

- Fines from labor inspections due to unregistered contracts and unpaid social insurance contributions.

- Prolonged labor disputes due to unclear contractual terms.

- Reputational damage, affecting business partnerships and future opportunities.

Legalizing the workforce ensures full compliance with labor laws, mitigating these risks effectively.

2. Optimizing Operational Costs

Instead of dealing with penalties and costly labor disputes, businesses can significantly reduce expenses by leveraging professional Employer of Record (EOR) services. Structured workforce management allows companies to optimize salary and benefits funds while maintaining financial transparency.

Case Study: A manufacturing company with around 200 employees faced a potential financial setback of billions of VND due to unpaid social insurance. However, by legalizing its workforce early, the company proactively managed costs and avoided legal complications.

3. Building a Professional Business Image

Companies with transparent and well-structured HR policies earn higher credibility among investors, partners, and employees. Compliance with labor laws showcases a company’s commitment to its workforce and corporate responsibility.

4. Supporting Long-Term HR Strategy

Employer of Record (EOR) enables businesses to establish a sustainable HR management system, facilitating seamless expansion without legal obstacles. This is particularly critical for companies in rapid growth phases.

Key Considerations for Employer of Record (EOR)

1. Choosing the Right Legalization Model

Depending on a company’s specific needs, different approaches can be adopted:

- Direct employment contracts: Suitable for long-term employees.

- Outsourced HR services: Ideal for businesses requiring workforce flexibility, especially for short-term projects.

- Partnering with Employer of Record (EOR) providers: Enables companies to delegate HR processes to professional service providers, reducing internal management burdens.

2. Ensuring Transparency in Employment Contracts

A legally compliant employment contract should include:

- Clearly defined rights and obligations for both employer and employee.

- Updates reflecting the latest regulations on insurance, leave policies, and compensation.

- Clauses safeguarding both parties in case of disputes.

3. Keeping Up with Social Insurance and Tax Policies

Businesses must stay updated on the latest social insurance contribution rates, mandatory deductions, and income tax policies. Compliance ensures financial efficiency while avoiding potential fines and disputes.

Employer of Record (EOR) and Its Impact on Business Growth

Enhancing Competitive Advantage

Legally compliant businesses with structured HR systems can expand operations more efficiently, access international markets, and attract large-scale investment.

Ensuring Internal Stability

Employer of Record (EOR) minimizes labor disputes, fostering a transparent and professional work environment.

Streamlining HR Management Processes

By integrating HR technology solutions, businesses can automate payroll, contract management, and insurance contributions, reducing administrative burdens.

Leveraging Technology for Employer of Record (EOR)

Digital solutions simplify EOR service by enabling online contract signing, automated insurance management, and secure employee data storage. Incorporating technology enhances compliance, efficiency, and accuracy.

Key Recommendations for Businesses

- Stay updated on regulatory changes: Labor laws constantly evolve, and staying informed helps businesses remain compliant.

- Choose a reputable service provider: A professional Employer of Record (EOR) partner ensures compliance while saving time and resources.

- Develop a structured internal HR system: From contract management to tax compliance, a clear and well-organized HR framework ensures smooth operations.

EOR service is not just a legal requirement but a strategic necessity for businesses aiming for stability, cost efficiency, and competitive advantage. Partnering with a professional service provider like NIC Global ensures a seamless and legally compliant workforce management process. Companies should take proactive steps to ensure compliance and long-term business sustainability.

📞 Contact NIC Global today for expert Employer of Record (EOR) solutions!

For contact and support:

Facebook: NIC Global – Human Resource Solutions

LinkedIn: NIC Global Sourcing JSC

Website: www.nicvn.com

Email: info@nicvn.com

Hotline: 0981.23.43.76

Address:

- Hanoi Office: No. 3A Thi Sach, Pham Dinh Ho Ward, Hai Ba Trung District, Hanoi, Vietnam

- Ho Chi Minh City Office: Dakao Center Building, 35 Mac Dinh Chi, District 1, Ho Chi Minh City, Vietnam

See more:

Payroll service

Staffing service

EOR service